ES Weekly Profiles and Positioning | 12.28.25 |

For new subscribers—

I use Fibonacci Sequences as the core of my analysis. I do implement both mechanical and contextual levels (from market profiles) in my analysis. I typically use mechanical levels to identify potential areas of support/distribution.

If you do enjoy my posts and want to support it by liking it, that is greatly appreciated!

Just a quick note—

I color code just so they are easier to read and understand, since there are alot levels with fibs.

Blue - potential discount zones (support levels)

Purple - zones I’m looking for price to defend, (line in the sand)

Red - premium zones (resistance / distribution zones)

If all you want is levels scroll to the bottom.

Announcement

Sorry I got tied up with my family around holidays + my bday was Dec 10, I ended up just getting of my comp almost completely which was nice. I was starting to feel super burnt out.

Anyways, with new year starting, I am going to explore new structures for posting schedules, like including more stocks / crypto.

My goal is to post daily and find a sustainable structure to support that.

I appreciate everyone who reads and supports me! I cant believe there is 1k+ of you guys now.

For those who have been following me for a while— you might remember I started this substack in July after my German Sheperd of 13 years passed, to have something to focus on. Unfortunately I focused so hard I got really burnt out lol.

So your support really does mean more than words can express, and I express gratitude to everyone that supported me along this journey. It is very tough to find work / life balance.

Love u guys

Salti

News Prints this week

Not really much going on — Just a reminder there is a bank holiday Thursday and markets will be closed

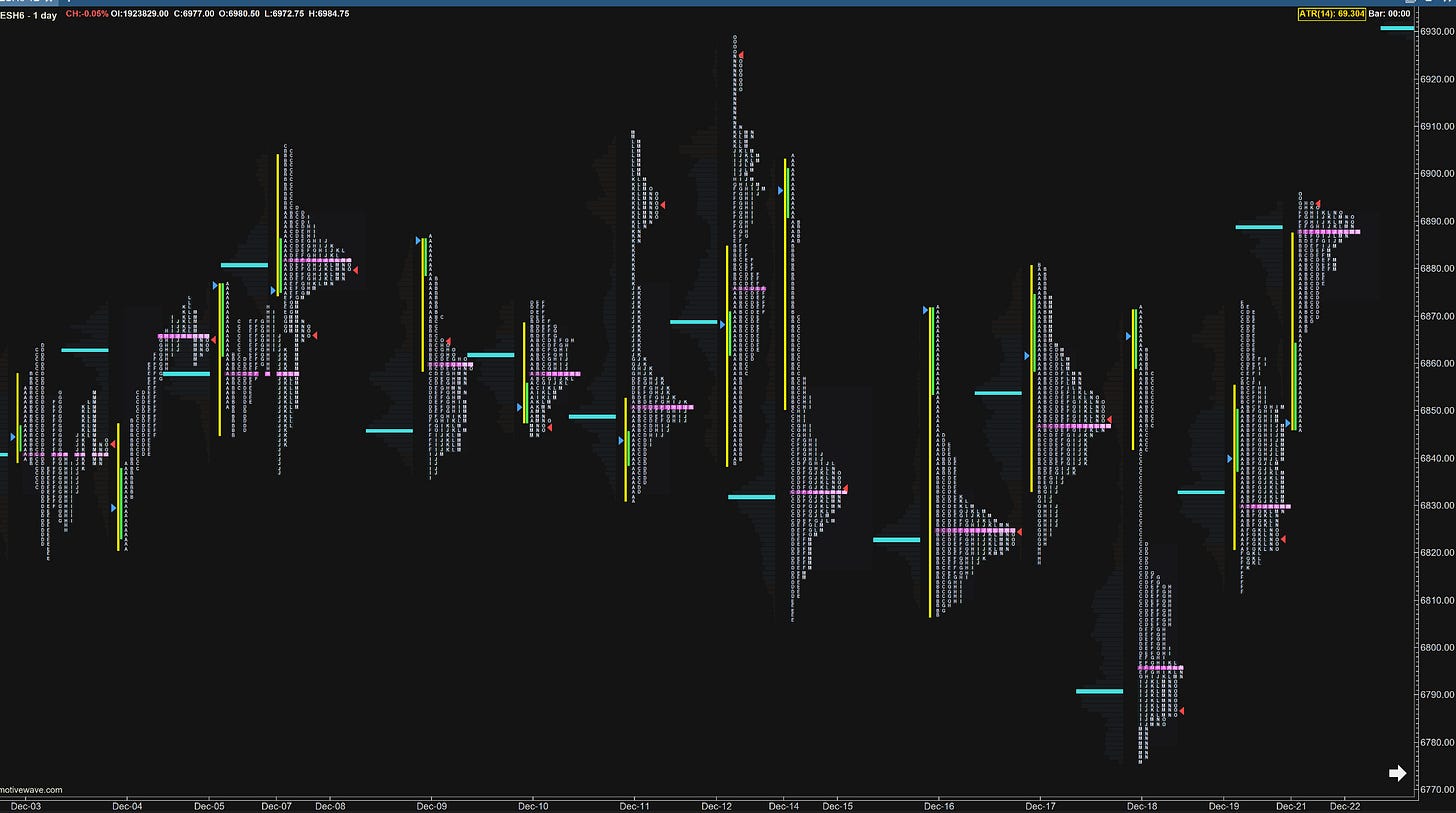

Starting with Market Profiles for ES

You can see here just how choppy and range bound it is. This is a very tough market to trade, just going into multi week balance.

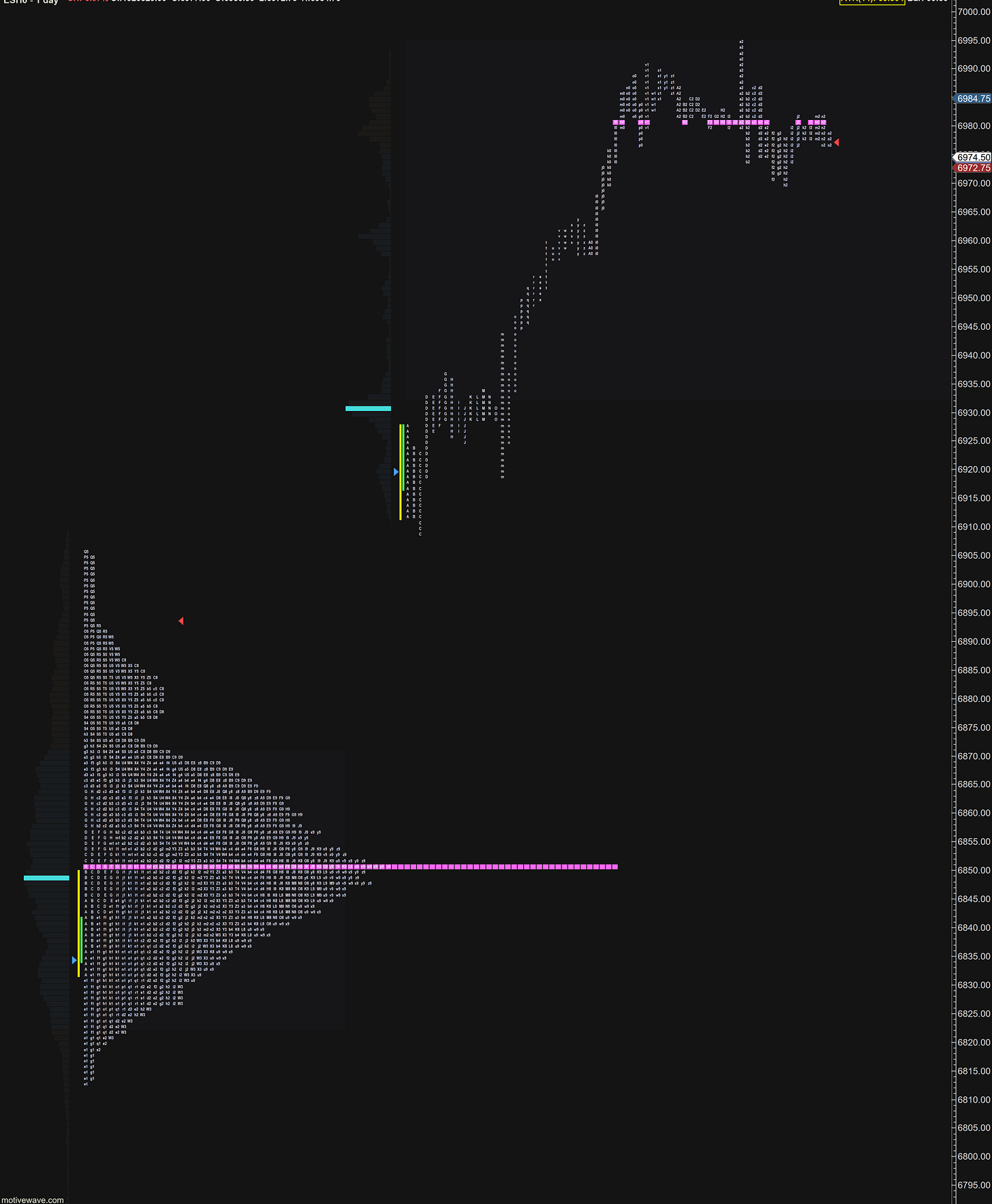

Its easier to see here with the market profiles combined. Nice clean balanced profile, followed by a break out of balance.

It appears that we do have some low volume regions to fill in still, hopefully we can get some pullbacks to retest downside support followed by a continuation higher,

If not we will rotate lower and look for more buyers.

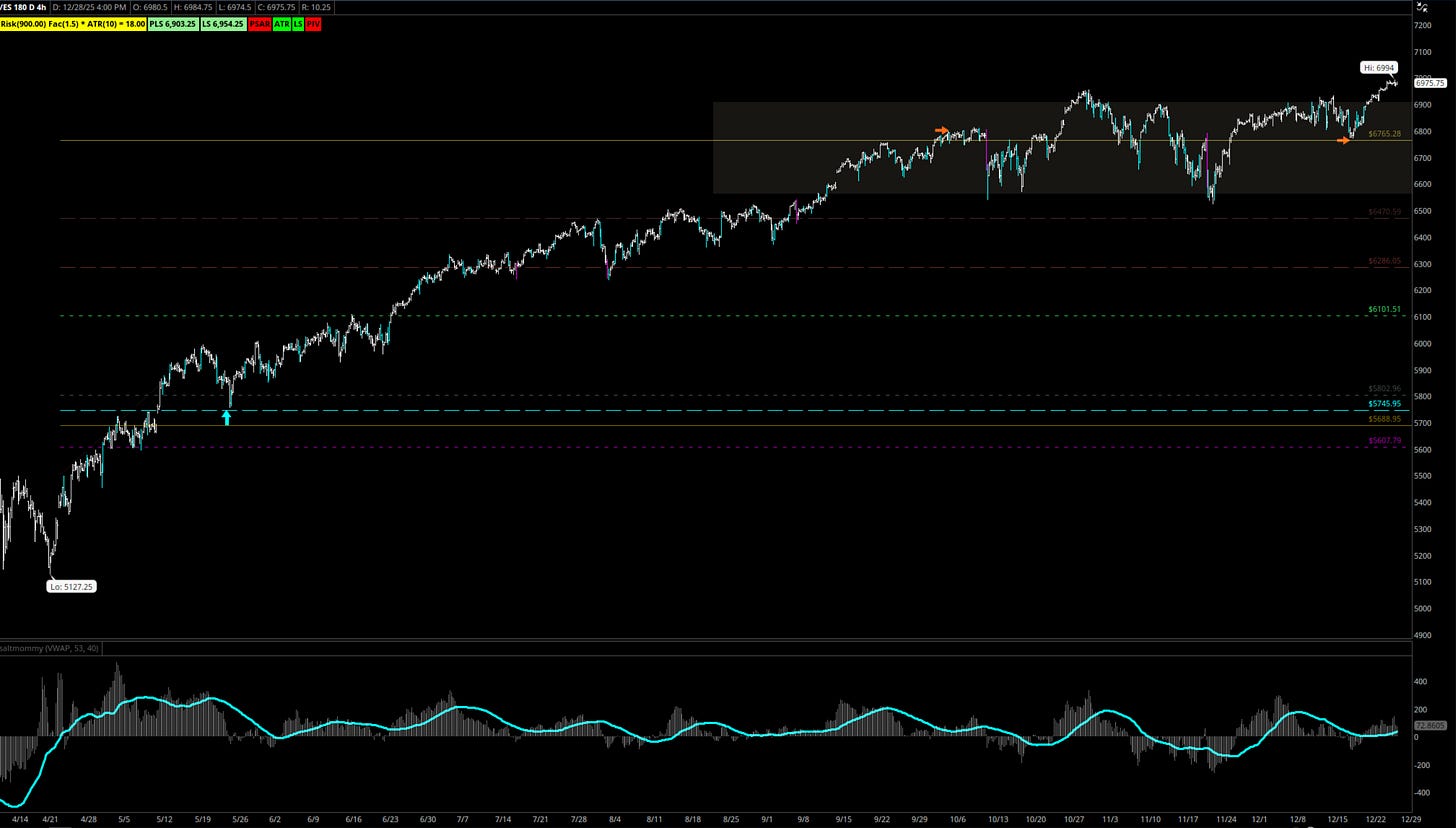

Starting off with a higher time frame —

We are coming into some bigger extension completion, we see some consolidation around that level at 6765

This holds first as resistance, and then later as support. (orange arrows)

We start this new sequence as we broke out of balance, reflected by the increase in buying momentum visible on the lower study.

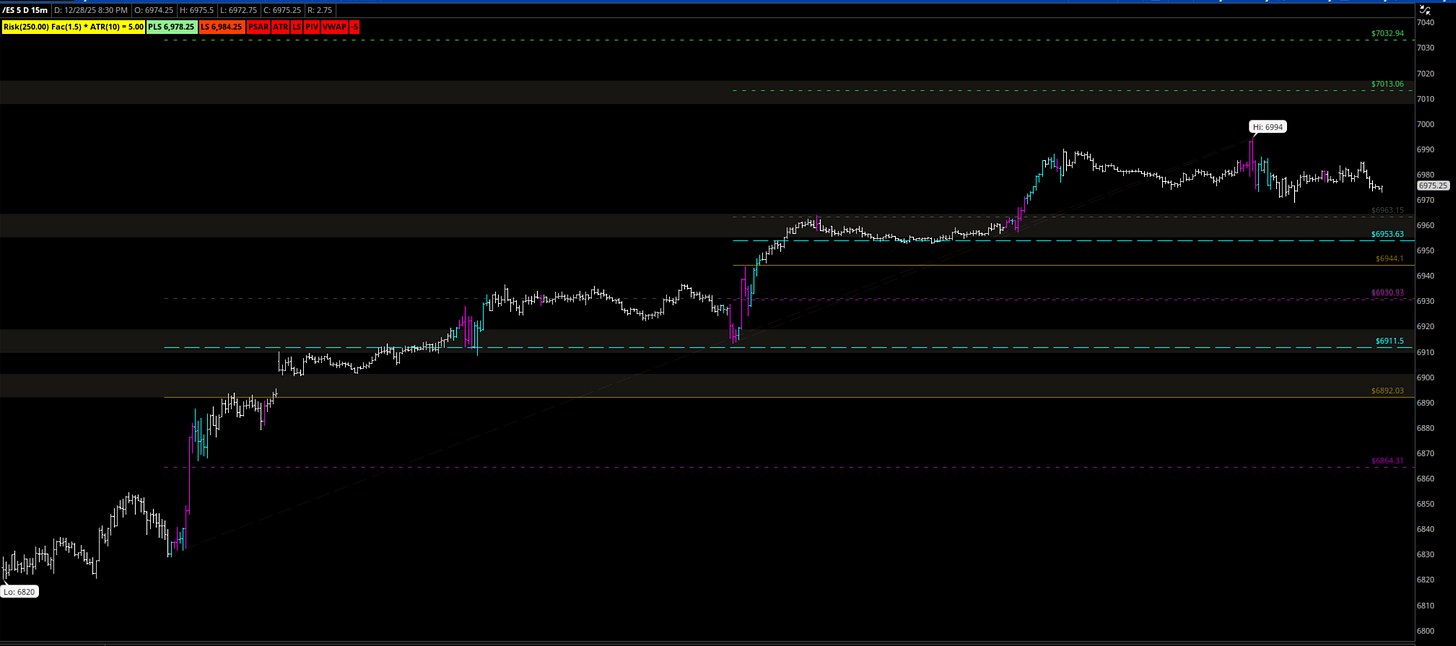

Here are the levels i’m looking for — I have ETH on right now —

Downside support at

6953-6963

6911 | 6892

Line in the sand

6930

6864

Upside targets

6994 | 7013 | 7032

Break and hold ABOVE 6980 for continuation higher as we retest highs for overhead supply.

You can find my video analysis below

Thats all I got— Trade safe this week yall!